Event Based Trading

An optimal combination of trade routing coupled with robust risk management and real-time trade cost analytics to implement portfolio transactions using multiple liquidity venues and trade strategies in order to achieve best execution across all major asset classes and markets.

Components:

Destination/Venue Research: Venue Neutral Liquidity Discovery

The team members at Vertas had historically served clients as independent brokerage advisors capable of identifying, and utilizing , the best performing and most appropriate institutional traders to execute each separate brokerage event, utilizing a proprietary ranking model based on empirical trade data in order to create a ranking system for executing brokers. Now "broker search and selection" has taken on a different meaning, as the new paradigm is "intelligently sourced liquidity" from the most optimal execution brokers/ venues' among the dozens and dozens of different execution alternatives. Today the performance based model pioneered by the Vertas team has evolved to utilize real time trade data and a robust liquidity scorecard to agnostically route trades to locate the best prices and timing without the revenue-driver concerns of broker owned "dark pools" and the associated potential conflicts of interests inherent in such ownership structures.

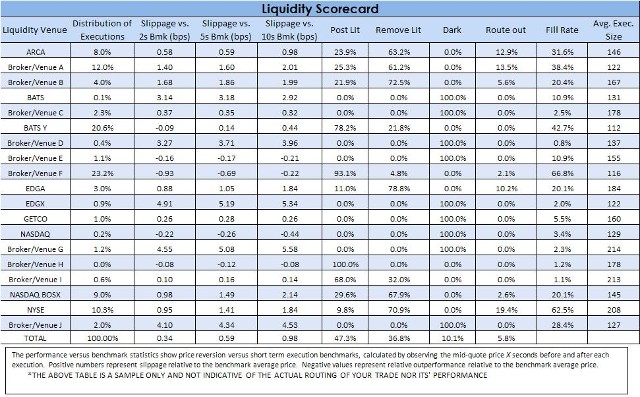

Sample Vertas Liquidity Scorecard (click image below to enlarge):

The Below Liquidity Scorecard (presenting dummy data only) is an example of the various trading performance metrics and benchmarks that are utilized in the decision making process of increasing or decreasing the flow of order volume to any particular execution/liquidity venue. In its simplest terms, the better the execution quality within any venue, the greater the volume of order flow that heads towards that venue, and vice versa. The Scorecard illustrates how the use of real time performance data during trading can drive order flow to those venues offering the best performance.

Real Time Trade Oversight: Modifying Behavior through Real Time Oversight

Vertas is in the role of master trader, monitoring execution on a real time basis and providing pension systems with an advocate on the desk on trade day and throughout the transition process.

Independent Reporting: Stop Brokers from Self-Reporting on their Trading Performance

(I) Pre-Trade Analysis

As an independent consultant, we believe that a pre-trade analysis should be much more than a cost estimate. A pre-trade analysis should clearly detail all of the decision elements in the trading process (trade strategy, broker/routing and cost estimate). Vertas utilizes a totally independent and standardized pre-trade algorithm based on the tick level pricing resulting in an accurate trade cost estimate.

(II) Post-Trade Analysis

Similar to the pre-trade analysis, Vertas provides the plan with an independent and objective post-trade performance attribution report. Vertas measures the performance of each transaction by analyzing multiple benchmarks (the same way performance attribution is analyzed in the investment world), ensuring that the executing broker cannot "hide" behind a single metric and, in turn cannot take credit for general market performance. Inherent in the benchmarks are all of the costs associated with completing a transition.

Trade Administration

Vertas trade administration platform ensures that proper controls are in place to manage operational risk during event based transactions, including the seamless transfer of securities and cash. Vertas' proprietary administration process adheres to a stringent management format designed to complete all variations of a transaction. This includes manager termination templates, custodial reports such as authorization and account set up documents, transfer instructions, cash summary reports, and fund manager correspondence, thereby eliminating all of the monotonous administrative tasks and potential risks that were previously handled by the investor. Furthermore Vertas develops an event-specific procedural timeline for each and every transaction that encompasses a step-by-step process for completing each phase of the transaction from start to finish.

Trade Cost Analytics

Equity Execution Cost Management

Vertas' unique tick based analysis isolates the cumulative impact of your trading decisions and helps you drill into the specifics of your trading activity by:

- Uncovering the key drivers of trading costs;

- Analyzing brokers, managers, algorithms, strategies, and trade destinations with confidence;

- Determining your trade related strengths and weaknesses;

- Monitoring your performance relative to industry benchmarks and peer groups; and

- Fine tuning your entire trade process and increasing your opportunity for best execution.

Fixed Income Analysis

The Vertas Fixed Income Stress Test provides clients with the industry's most comprehensive independent analysis and evaluation of liquidity, estimated transaction costs, and mark-to-market valuation differentials in fixed income portfolios. Utilizing third party quantitative and qualitative sources, the "Stress Test" is a confidential report that will help clients achieve greater transparency and insight while ensuring best practices are in place by:

- Evaluating liquidity at the portfolio, asset class, sector, and security level;

- Estimating tranasaction costs of potential changes to the underlying portfolio or individual managers;

- Identifying mark-to-market differentials between custodian, investment manager, and broker-dealer valuations;

- Calculating sector and sub sector exposures by asset class and security; and

- Computing credit quality and duration using the latest available pricing information.

Vertas Brokerage Consulting ius a discrete unit of Percival Financial Partners Ltd